Evaluating Property Listings With a Long-Term Lens

When browsing the real estate market, it’s tempting to let price be the deciding factor. However, property listings are more complex than their listed cost. Location, condition, potential liabilities, and even future growth possibilities should factor into every decision.

Buyers who assess listings from a broader perspective often make smarter investments with better long-term value. Whether you’re looking for a commercial space or residential property, the sticker price is only one piece of the puzzle.

Evaluating Property Condition and Maintenance History

One of the first considerations beyond price is the property’s physical condition. A lower price tag might mask deferred maintenance, outdated systems, or structural issues. On the other hand, a well-maintained building that appears more expensive upfront may require fewer upgrades and save money over time.

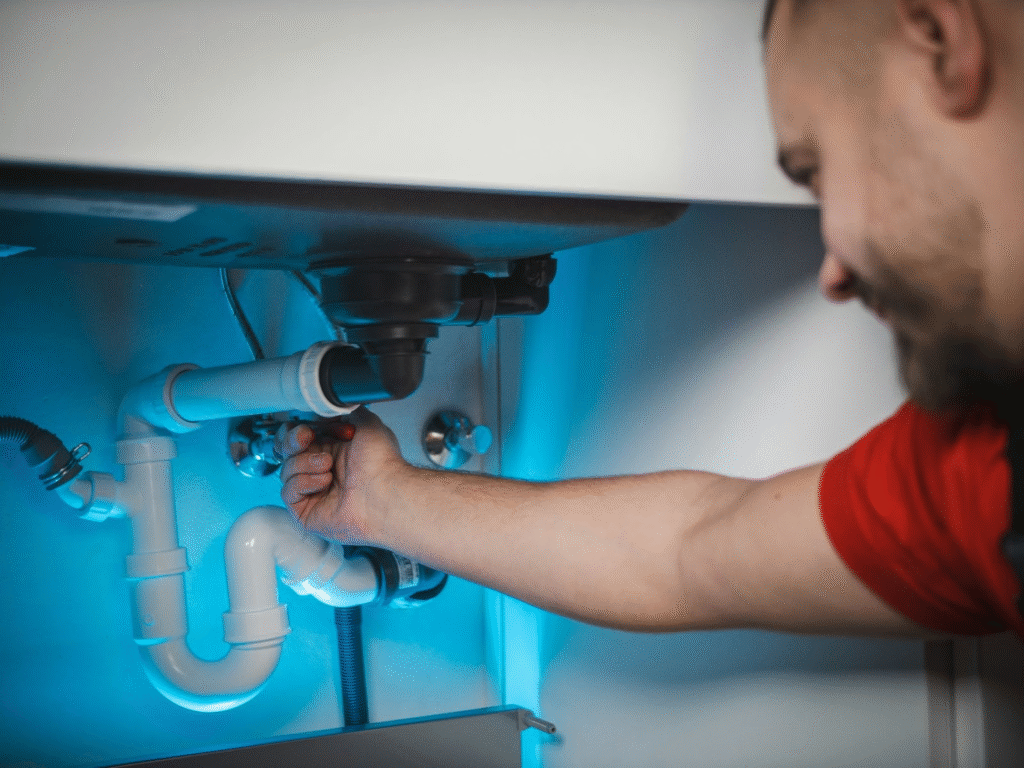

Understanding the property’s repair history, age of the roof, HVAC systems, plumbing, and electrical infrastructure can reveal hidden costs or benefits that aren’t immediately apparent in the listing.

Considering Location and Surrounding Development

Location is more than a postal code—it encompasses school districts, nearby businesses, traffic patterns, and potential for future development. A slightly more expensive property in a growing neighborhood may outperform a cheaper option in a stagnant area.

Commercial buyers, in particular, should assess local infrastructure and accessibility, as these factors can impact customer traffic, delivery logistics, and staff commuting. Long-term return on investment depends greatly on where the property sits in the broader landscape of development and demographics.

Reviewing Zoning Laws and Future Use Potential

Zoning regulations determine how a property can legally be used and can significantly impact its flexibility and value. For those purchasing with future development or business goals in mind, checking whether the property aligns with local zoning laws is essential.

A listing might look attractive in terms of square footage or land area, but restrictive zoning could limit how the space is utilized or expanded. Researching future urban plans or rezoning possibilities can provide insights into the long-term utility of the property.

Factoring in Insurance and Risk Exposure

Another critical layer involves the cost and accessibility of insurance. Commercial buyers especially should investigate whether the property is located in areas prone to flooding, wildfires, or other environmental risks. Insurance premiums can be substantial and should be factored into the overall budget.

Working with a provider like Afinida Insurance can offer valuable clarity about what kind of coverage the property might require and whether it’s adequately protected. These insights not only inform budgeting but also help protect the investment from avoidable financial loss.

Weighing Amenities, Layout, and Functionality

Beyond structural integrity, the internal layout and available amenities also matter. A property with high ceilings, natural lighting, or energy-efficient design can better support specific operational or lifestyle needs.

For commercial real estate, functionality includes factors like parking availability, loading docks, conference areas, and the flexibility to adapt to evolving business models. Often, these elements go underappreciated in cost comparisons, but they can greatly influence the daily experience of occupants and staff.

Assessing Long-Term Value and Resale Prospects

When evaluating property listings, it’s crucial to adopt a long-term perspective rather than focusing solely on immediate acquisition costs. A forward-thinking approach involves considering several key factors that can impact a property’s value and desirability over time.

Will the property appreciate? This depends on regional economic health, housing demand, and market trends. Evaluate if the location will become more desirable due to infrastructure, job growth, new amenities, or demographic shifts.

Research local development plans, as new projects can increase property value, while a lack of development can hinder it. Understanding long-term prospects helps buyers make informed decisions and secure lasting value. Commercial real estate particularly benefits from a forward-thinking approach, assessing listings for future value retention. Factoring in appreciation potential can lead to a better overall return, even with a higher upfront cost.

Balancing Aesthetics With Practical Considerations

When evaluating property listings, it’s crucial to look beyond initial impressions and apply a long-term, strategic lens. While a visually appealing listing can immediately capture interest, a deeper investigation is essential to ensure that the aesthetic appeal aligns with the property’s practical purpose and long-term viability.

Historic buildings, though charming, often entail substantial maintenance, specialized materials, and strict preservation guidelines. These restrictions limit adaptability and can increase costs and reduce flexibility.

Practical advantages like flexible layouts and modern infrastructure in seemingly bland listings can lead to lower upkeep and greater freedom for future enhancements. Buyers should balance emotional appeal with practical value, focusing on structure, functionality, and long-term economic implications for a comprehensive evaluation of present appearance and future demands, adaptability, and ROI.

When comparing property listings, focusing solely on price can lead to costly oversights. Savvy buyers assess condition, location, zoning, insurance implications, and long-term value to make informed decisions.

By going beyond surface-level comparisons, it’s possible to find a property that aligns with both immediate goals and future growth. Whether working with a commercial real estate agent or doing your own research, taking a broader view ensures you choose more than just a good deal—you choose a smart investment.